BlackBerry (NASDAQ: BBRY ) CEO Thorsten Heins is just sounding silly now. In a recent interview with Bloomberg, Heins expresses skepticism over the broader tablet movement.

"In five years I don't think there'll be a reason to have a tablet anymore," Heins is quoted as saying, "Maybe a big screen in your workspace, but not a tablet as such. Tablets themselves are not a good business model."

Oddly enough, Heins goes on to say, "In five years, I see BlackBerry to be the absolute leader in mobile computing -- that's what we're aiming for. I want to gain as much market share as I can, but not by being a copycat."

That's an oxymoron if I've ever heard one. Mobile computing includes a secular shift toward smartphones and tablets, but you could also arguably include shifting from desktops to laptops within the PC market. Of the three devices that embody mobile computing -- smartphones, tablets, and laptops -- BlackBerry only sells one.

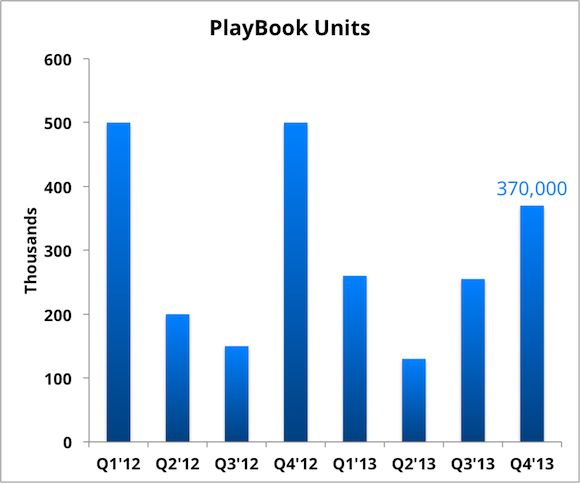

It's certainly true that tablets have not been a good business for BlackBerry. Shortly after jumping into the market with the PlayBook, the company promptly recorded a pre-tax non-cash charge of $485 million related to a glut of unsold inventory. While PlayBook unit shipments haven't been consistent, to the company's credit they're holding up relatively well for a device that's two years old and only received minor upgrades. That may also be a function of the price dropping from $500 to under $200 over the past two years.

Source: BlackBerry. Fiscal quarters shown.

The tablet market is also much harder to crack competitively. Not only does BlackBerry have to compete with market leader Apple (NASDAQ: AAPL ) and its iPad and iPad Mini, but on the low end habitual disrupters Amazon.com (NASDAQ: AMZN ) and Google (NASDAQ: GOOG ) are perfectly content selling hardware at cost.

The e-tail and search giants have ensured that there really isn't much in the way of hardware margins down there, which is where the PlayBook is currently positioned. Of course, the tablet market is proving to be a good business model for Apple, Amazon, and Google. The iPad remains Apple's fastest-growing new product category, Amazon has expanded its content ecosystem, and Google has dramatically broadened the global reach of its ads and services.

Just because BlackBerry's tablet business isn't good doesn't mean others can't enjoy it. Sorry, Heins, but it's simply not possible to become the "absolute leader in mobile computing" without tablets.

There's a debate raging as to whether Apple remains a buy. The Motley Fool's senior technology analyst and managing bureau chief, Eric Bleeker, is prepared to fill you in on reasons to buy and reasons to sell Apple, and what opportunities are left for the company (and your portfolio) going forward. To get instant access to his latest thinking on Apple, simply click here now.

.png)