Lockheed Martin Corp. (LMT), through its Mission Systems and Training unit, won a firm-fixed-price contract from the Department of Defense (DoD) for six B-2 line replaceable units, data, material lay-in, and overhaul management.

The contract has a total value of $53.6 million with the primary three-year period expected to wind up by Jul 2016. Lockheed Martin also has an additional two-year option period till 2018 to perform the work.

Lockheed has received numerous contracts in the last few months thanks to its diversified operations focusing on ISR, unmanned systems, force protection, cyber security, and missile defense.

Bethesda, Md.-based Lockheed Martin is a global security and aerospace company that is principally engaged in the research, design, development, manufacture, integration and sustainment of advanced technology systems, products and services.

Earlier this month, a Lockheed Martin business wing, Mission Systems and Training, won a $295 million DoD contract for work on the Aegis missile defense. This is a sole-source, cost-plus-incentive-fee/cost-plus-award-fee/cost-plus-technical-schedule incentive fee contract modification, under which Lockheed Martin will provide system engineering and program management services. This is mainly intended for the development of Aegis Ballistic Missile Defense Baseline, which would support the 5.1 variant through the Critical Design Review and Increment-2 through the Preliminary Design Review. The company�� work on the contract will continue through Mar 30, 2015.

Hot Tech Companies To Watch For 2014: Yucheng Technologies Limited(YTEC)

Yucheng Technologies Limited, together with its subsidiaries, provides information technology (IT), software, and solutions and services for state-owned commercial banks in the People?s Bank of China. The company offers systems integration, software solution, IT consulting and training, platform, and maintenance and support services; and undertakes computer network projects, as well as engages in the sale of IT products, computer software, hardware and peripheral equipment, and communication equipment. Its software and solutions include business solutions, which consist of core-banking, foreign exchange, and loan management; channel solutions that comprise customized online banking solutions, E-Banking ASP, and call center solutions to improve communication and transaction with its customers; and management solutions comprising a suite of consulting and implementation services in risk and performance management, such as asset and liability management, funds transfer prici ng, and profitability analysis that help banks to collect and analyze data. The company is headquartered in Beijing, the People?s Republic of China.

Hot Tech Companies To Watch For 2014: Plexus Corp.(PLXS)

Plexus Corp., together with its subsidiaries, provides electronic manufacturing services to original equipment manufacturers and other technology companies. The company offers product development and design services, including program management, feasibility studies, product conceptualization, specification development, circuit design, field programmable gate array design, printed circuit board layout, embedded software design, mechanical design, development of test specifications, and product verification testing. It also provides value-added services, such as engineering change-order management, cost reduction redesign, component obsolescence management, product feature expansion, test enhancement, and component re-sourcing. In addition, the company offers prototyping and new product introduction services comprising assembly of prototype products, materials management, analysis of the manufacturability and testability of a design, test implementation, and pilot productio n. Further, it provides test equipment development; material sourcing and procurement; agile manufacturing; fulfillment and logistic; after-market support; and regulatory requirements services. The company serves the wireline/networking, wireless infrastructure, medical, industrial/commercial, and defense/security/aerospace markets in the United States, Malaysia, China, the United Kingdom, Mexico, and Romania. Plexus Corp. was founded in 1979 and is headquartered in Neenah, Wisconsin.

Advisors' Opinion: - [By Evan Niu, CFA]

What: Shares of Plexus (NASDAQ: PLXS ) have jumped today by as much as 13% after the company reported earnings results.

So what: Revenue in the fiscal third quarter totaled $571.9 million, well ahead of the Street consensus of $565 million. Earnings per share were $0.68, similarly topping expectations of just $0.58 per share. CEO Dean Foate said the strong results were driven by the networking and communications as well as the health care and life sciences sectors.

- [By Seth Jayson]

Plexus (Nasdaq: PLXS ) reported earnings on July 17. Here are the numbers you need to know.

The 10-second takeaway

For the quarter ended June 29 (Q3), Plexus beat slightly on revenues and beat expectations on earnings per share.

France Telecom provides fixed telephony and mobile telecommunications, data transmission, Internet and multimedia, and other value-added services to consumers, businesses, and telecommunications operators. It also offers personal and home communication services, business network services, international carriers and shared services, and integration and outsourcing services for communication applications. The company operates in France, Spain, Poland, the United Kingdom, and internationally. France Telecom was founded in 1990 and is based in Paris, France.

Advisors' Opinion: Hot Tech Companies To Watch For 2014: Open Joint Stock Company "Vimpel-Communications"(VIP)

VimpelCom Ltd. operates as an integrated telecommunications services provider, offering voice and data services through a range of wireless, fixed, and broadband technologies. It provides its services under the Beeline, Kyivstar, djuice, Wind, Infostrada Mobilink, Leo, Banglalink, Telecel, Mobinil, koryolink, Allo, and Djezzy brands. The company also offers roaming services that allows its subscribers and the customers of other mobile operators to receive and make international, local, and long distance calls while outside of their home network. In addition, it provides mobile telecommunications, as well as fixed-line, data, and long distance licenses. As of December 31, 2010, the company had 92.7 million mobile subscribers. It offers its services in Russia, Ukraine, Kazakhstan, Uzbekistan, Tajikistan, Armenia, Georgia, Kyrgyzstan, Vietnam, Cambodia, Laos, Algeria, Bangladesh, Pakistan, Burundi, Zimbabwe, Namibia, Central African Republic, Italy, and Canada. VimpelCom Ltd. is headquartered in Amsterdam, the Netherlands.

Advisors' Opinion: - [By Dividend]

REITs, asset managers and communication stocks are dominating the screen. That�� where you can find the highest dividend yields but the risk is also much higher.

Here are my favorite stocks:

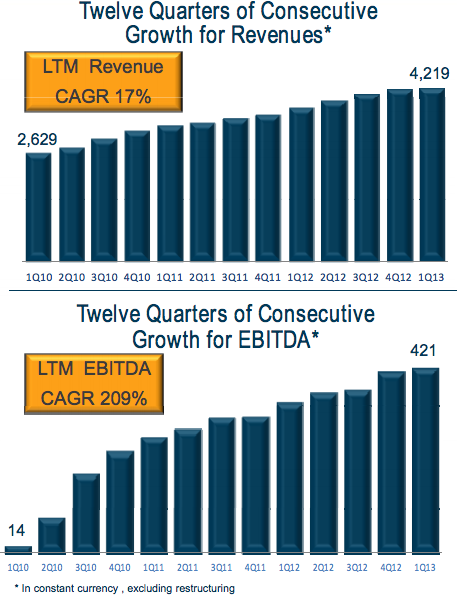

VimpelCom (VIP) has a market capitalization of $22.62 billion. The company employs 58,184 people, generates revenue of $23.061 billion and has a net income of $1.982 billion. VimpelCom�� earnings before interest, taxes, depreciation and amortization (EBITDA) amounts to $9.768 billion. The EBITDA margin is 42.36 percent (the operating margin is 18.09% and the net profit margin 8.59%).

- [By Eric Volkman]

VimpelCom (NASDAQ: VIP ) is to pass along a pair of payouts for its shareholders. Simultaneously, the company declared both a regular and a special dividend. For the former, the telecom will distribute $0.35, and for the latter, $0.79 per American depositary share. The company expects to pay both by May 15 to shareholders of record as of April 29.

Hot Tech Companies To Watch For 2014: Pegasystems Inc.(PEGA)

Pegasystems Inc. develops, markets, licenses, and supports software to automate business processes primarily in the United States, the United Kingdom, and rest of Europe. The company offers PegaRULES Process Commander, which provides a platform to build, deploy, and change enterprise applications; purpose or industry-specific solution frameworks that enable organizations to implement new customer-facing practices and processes, and provide customized or specialized processing to meet the needs of different customers, departments, geographies, or regulatory requirements; and Pega customer relationship management software to automate customer service inquiries and marketing, and apply analytics to predict and adapt customer service processes. It also offers Pega decision management products, which include Pega Decision Strategy Manager and Next-Best-Action Advisor that support decision-making for offer management, risk, and other marketing and customer management solutions; and Pega Cloud, which enables customers to create and/or run Pega applications using an Internet-based infrastructure. In addition, the company provides implementation, consulting, training, and technical support services to its customers. The company markets its software and services primarily through its direct sales force to financial services organizations, healthcare organizations, insurance companies, communications and media organizations, and government agencies. Pegasystems Inc. was founded in 1983 and is headquartered in Cambridge, Massachusetts.

Hot Tech Companies To Watch For 2014: Top Image Systems Ltd.(TISA)

Top Image Systems Ltd. provides enterprise solutions for managing and validating content entering organizations from various sources. It develops and markets automated data capture solutions for managing and validating content gathered from customers, trading partners, and employees. The company?s solutions deliver digital content to the applications that drive an enterprise by using technologies, such as wireless communications, servers, form processing, and information recognition systems. It offers eFLOW Unified Content Platform that provides the common architectural infrastructure for its solutions. The company also provides Smart, an automated classification solution, which is the eFLOW plug-in for unstructured content providing single point of entry for information entering the organization; and Freedom, the eFLOW plug-in for semi-structured content that enables customers to identify and capture critical data from semi-structured documents, such as invoices, purchase orders, shipping notes, and checks. In addition, it offers Integra, the eFLOW plug-in for structured content, which provides a solution for data capture, validation, and delivery from structured predefined forms; eFLOW Ability, an integrated module interfacing with SAP systems for automated parking, approval, and posting of invoices and other document within SAP systems; and eFLOW Invoice Reader, an invoice capture and approval solution, which could be deployed and integrated in enterprise accounting environment, such as SAP, Oracle, and other financial systems. Top Image Systems Ltd. sells its products through a network of value-added distributors, systems integrators, original equipment manufacturers, and partners in approximately 40 countries worldwide. It has strategic partnership with SQN Banking Systems (SQN) to incorporate SQN's fraud detection solutions with its eFLOW Banking Platform in the Asia Pacific market. The company was founded in 1991 and is headquartered i n Ramat Gan, Israel.

Surveying the damage pictured above: (-7.53%) - Utilities, IDU (-7.63%) - Long-term U.S. Treasury Bonds, TLT (-9.25%) - Master Limited Partnerships, AMJ (-15.96%) - REITs, VNQ The FOMC Spin Cycle Investors feared that sharply rising rates would make the investment options above less attractive in comparison to "risk free" assets like U.S. Treasury bonds. After the initial rout, we saw a remarkable snap-back recovery in all four asset classes displayed above (with the exception of Treasury bonds) as Big Ben pacified the markets with rhetoric and rates eased. Then in July, as speculation centered around Larry Summers as most likely to succeed Bernanke, the 10-year spiked to 3.00% and our dividend-payers fell once more. The key ingredient for these asset classes isn't as simple as "low rates good, rising rates bad." Truly, it's the spread between the yields being kicked off by these investments, taken in comparison with those of the risk-free Treasury.

Surveying the damage pictured above: (-7.53%) - Utilities, IDU (-7.63%) - Long-term U.S. Treasury Bonds, TLT (-9.25%) - Master Limited Partnerships, AMJ (-15.96%) - REITs, VNQ The FOMC Spin Cycle Investors feared that sharply rising rates would make the investment options above less attractive in comparison to "risk free" assets like U.S. Treasury bonds. After the initial rout, we saw a remarkable snap-back recovery in all four asset classes displayed above (with the exception of Treasury bonds) as Big Ben pacified the markets with rhetoric and rates eased. Then in July, as speculation centered around Larry Summers as most likely to succeed Bernanke, the 10-year spiked to 3.00% and our dividend-payers fell once more. The key ingredient for these asset classes isn't as simple as "low rates good, rising rates bad." Truly, it's the spread between the yields being kicked off by these investments, taken in comparison with those of the risk-free Treasury.

+12.47% -- S&P 500 +16.11% -- Emerging Markets, VWO The higher the interest rates the United States pays on its debt, the higher rates these smaller and more economically sensitive nations must pay to attract investment in their own governments' debt. The logic is the same as when companies or borrowers with lower credit ratings have to pay higher interest rates to secure loans. Higher cost of funds creates additional headwinds for their growth; the converse is also true. What if I'm wrong, though? What if Rand Paul filibusters to block Yellen's nomination, or Yellen has a change of heart after accepting her nomination? If rates spike higher again, aren't we going to see the same pain that we endured for the entire month of June? Maybe. The trouble with that argument is you're not just fighting the Fed, whose primary objective is to see solid improvements in the labor market (specifically, an unemployment rate of 6.5%). You are also fighting retirees, endowments, pension funds, foreign governments and mutual funds who may be infinitely more interested in securing 3% on their fixed income portfolios than they are at 2%. Any increased appetite for our government's debt puts downward pressure on the interest rates we must pay to attract investment. Everything is relative. Yellen at the helm bodes well not just for our markets which may be getting a bit extended, but also for our small, foreign counterparts whose recovery is much less mature. As the world's largest economy, the scope of our policies cannot be measured simply by our unemployment rate and GDP growth. In fact, our unemployment and GDP growth depends more on the health of other economies than it ever has before. At the time of publication the author was long AMJ, VNQ & VWO. -- Written by Adam B. Scott This article is commentary by an independent contributor, separate from TheStreet's regular news coverage.

+12.47% -- S&P 500 +16.11% -- Emerging Markets, VWO The higher the interest rates the United States pays on its debt, the higher rates these smaller and more economically sensitive nations must pay to attract investment in their own governments' debt. The logic is the same as when companies or borrowers with lower credit ratings have to pay higher interest rates to secure loans. Higher cost of funds creates additional headwinds for their growth; the converse is also true. What if I'm wrong, though? What if Rand Paul filibusters to block Yellen's nomination, or Yellen has a change of heart after accepting her nomination? If rates spike higher again, aren't we going to see the same pain that we endured for the entire month of June? Maybe. The trouble with that argument is you're not just fighting the Fed, whose primary objective is to see solid improvements in the labor market (specifically, an unemployment rate of 6.5%). You are also fighting retirees, endowments, pension funds, foreign governments and mutual funds who may be infinitely more interested in securing 3% on their fixed income portfolios than they are at 2%. Any increased appetite for our government's debt puts downward pressure on the interest rates we must pay to attract investment. Everything is relative. Yellen at the helm bodes well not just for our markets which may be getting a bit extended, but also for our small, foreign counterparts whose recovery is much less mature. As the world's largest economy, the scope of our policies cannot be measured simply by our unemployment rate and GDP growth. In fact, our unemployment and GDP growth depends more on the health of other economies than it ever has before. At the time of publication the author was long AMJ, VNQ & VWO. -- Written by Adam B. Scott This article is commentary by an independent contributor, separate from TheStreet's regular news coverage.

Associated Press

Associated Press

Today's Wall Street darling: tech

Today's Wall Street darling: tech  Shutterstock.com Crude oil prices rises, but stay below $100 a barrel.

Shutterstock.com Crude oil prices rises, but stay below $100 a barrel.  Bambi Holzer

Bambi Holzer