Tony Dejak/AP WASHINGTON -- The U.S. economy barely grew in the first quarter as exports tumbled and businesses accumulated stocks at the slowest pace in nearly a year, but activity already appears to be bouncing back. Gross domestic product expanded at a 0.1 percent annual rate, the slowest since the fourth quarter of 2012, the Commerce Department said Wednesday. That was a sharp pullback from the fourth quarter's 2.6 percent pace and was worse than economists' expectations for a slowdown to a 1.2 percent rate. The slowdown partly reflected an unusually cold and disruptive winter, marked by declines in sectors ranging from business spending to home building. The Commerce Department's first snapshot of first-quarter growth was released just hours before the Federal Reserve wraps up a two-day policy meeting. While harsh weather partially explains the weakness in growth, the magnitude of the slowdown could complicate the U.S. central bank's message as it sets to announce a further reduction in the amount of money it is pumping into the economy through monthly bond purchases. U.S. stock index futures fell slightly on the report, while U.S. Treasury debt prices trimmed losses. The first-quarter stall in growth, however, is likely to be temporary and recent data have suggested strength at the tail end of the quarter. Separately, the ADP National Employment Report showed private employers added 220,000 jobs to their payrolls in April after increasing headcount by 209,000 in March. "This weakness is not carrying through the second quarter," said Gus Faucher, senior economist at PNC Financial Services in Pittsburgh. Economists estimate severe weather could have chopped off as much as 1.4 percentage points from GDP growth. The government, however, gave no details on the impact of the weather. Inventory Growth Decelerates Businesses restocked inventories to the tune of $111.7 bln in the final three months of last year, but added only $87.4 billion more to stocks in the first quarter, the smallest amount since the second quarter of 2013. The slowdown in restocking subtracted 0.57 percentage point from GDP growth in the first quarter. Trade also undercut growth, taking off 0.83 percentage point, partly because of the weather, which left goods piling up at ports. Exports fell at a 7.6 percent rate in the first quarter, the largest decline in five years, after growing at a 9.5 percent pace in the final three months of 2013. Together, inventories and trade sliced off 1.4 percentage points from GDP growth. A measure of domestic demand that strips out exports and inventories expanded at a 1.5 percent rate. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased at a 3 percent rate, reflecting a spurt in spending on services linked to demand for heating during the winter and the Affordable Healthcare Act, which expanded health care coverage to many Americans. Spending on services grew at its quickest pace since the second quarter of 2000. Spending on goods, however, slowed sharply, indicating that the frigid temperatures had reduced foot traffic to shopping malls. Consumer spending had increased at a brisk 3.3 percent pace in the fourth-quarter. Harsh weather also undercut business spending on equipment. While investment in nonresidential structures, such as gas drilling, rebounded, the increase was minor. Business spending on equipment fell at its fastest pace in nearly five years. Investment in home building contracted for a second straight quarter, in part because of the weather. But a rise in mortgage rates over the past year has also hurt. A second quarter of contraction in spending on home building suggests a housing recession, which could raise some eyebrows at the U.S. central bank. A bounce back is, however, expected in the April-June period.

Tony Dejak/AP WASHINGTON -- The U.S. economy barely grew in the first quarter as exports tumbled and businesses accumulated stocks at the slowest pace in nearly a year, but activity already appears to be bouncing back. Gross domestic product expanded at a 0.1 percent annual rate, the slowest since the fourth quarter of 2012, the Commerce Department said Wednesday. That was a sharp pullback from the fourth quarter's 2.6 percent pace and was worse than economists' expectations for a slowdown to a 1.2 percent rate. The slowdown partly reflected an unusually cold and disruptive winter, marked by declines in sectors ranging from business spending to home building. The Commerce Department's first snapshot of first-quarter growth was released just hours before the Federal Reserve wraps up a two-day policy meeting. While harsh weather partially explains the weakness in growth, the magnitude of the slowdown could complicate the U.S. central bank's message as it sets to announce a further reduction in the amount of money it is pumping into the economy through monthly bond purchases. U.S. stock index futures fell slightly on the report, while U.S. Treasury debt prices trimmed losses. The first-quarter stall in growth, however, is likely to be temporary and recent data have suggested strength at the tail end of the quarter. Separately, the ADP National Employment Report showed private employers added 220,000 jobs to their payrolls in April after increasing headcount by 209,000 in March. "This weakness is not carrying through the second quarter," said Gus Faucher, senior economist at PNC Financial Services in Pittsburgh. Economists estimate severe weather could have chopped off as much as 1.4 percentage points from GDP growth. The government, however, gave no details on the impact of the weather. Inventory Growth Decelerates Businesses restocked inventories to the tune of $111.7 bln in the final three months of last year, but added only $87.4 billion more to stocks in the first quarter, the smallest amount since the second quarter of 2013. The slowdown in restocking subtracted 0.57 percentage point from GDP growth in the first quarter. Trade also undercut growth, taking off 0.83 percentage point, partly because of the weather, which left goods piling up at ports. Exports fell at a 7.6 percent rate in the first quarter, the largest decline in five years, after growing at a 9.5 percent pace in the final three months of 2013. Together, inventories and trade sliced off 1.4 percentage points from GDP growth. A measure of domestic demand that strips out exports and inventories expanded at a 1.5 percent rate. Consumer spending, which accounts for more than two-thirds of U.S. economic activity, increased at a 3 percent rate, reflecting a spurt in spending on services linked to demand for heating during the winter and the Affordable Healthcare Act, which expanded health care coverage to many Americans. Spending on services grew at its quickest pace since the second quarter of 2000. Spending on goods, however, slowed sharply, indicating that the frigid temperatures had reduced foot traffic to shopping malls. Consumer spending had increased at a brisk 3.3 percent pace in the fourth-quarter. Harsh weather also undercut business spending on equipment. While investment in nonresidential structures, such as gas drilling, rebounded, the increase was minor. Business spending on equipment fell at its fastest pace in nearly five years. Investment in home building contracted for a second straight quarter, in part because of the weather. But a rise in mortgage rates over the past year has also hurt. A second quarter of contraction in spending on home building suggests a housing recession, which could raise some eyebrows at the U.S. central bank. A bounce back is, however, expected in the April-June period.

Top Stocks To Invest In 2014, Top Stocks To Buy For 2014

Monday, October 27, 2014

U.S. Economic Growth Slows to a Crawl in First Quarter

Saturday, October 25, 2014

5 Stocks Under $10 Set to Soar

DELAFIELD, Wis. (Stockpickr) -- There isn't a day that goes by on Wall Street when certain stocks trading for under $10 a share don't experience massive spikes higher. Traders savvy enough to follow the low-priced names and trade them with discipline and sound risk management are banking ridiculous coin on a regular basis.

Must Read: Warren Buffett's Top 10 Dividend Stocks

Just take a look at some of the big movers in the under-$10 complex on Friday, including IsoRay (ISR), which is ripping higher by 25%; Amedica (AMDA), which is exploding higher by 19%; Alpha Pro Tech (APT), which is spiking higher by 13%; and Aehr Test Systems (AEHR), which is moving to the upside by 13%. You don't even have to catch the entire move in lower-priced stocks such as these to make outsized returns when trading.

Low-priced stocks are something that I tweet about on a regular basis. I frequently flag high-probability setups, breakout candidates and low-priced stocks that are acting technically bullish. I like to hunt for low-priced stocks that are showing bullish price and volume trends, since that increases the probability of those stocks heading higher. These setups often produce monster moves higher in very short time frames.

When I trade under-$10 names, I do it almost entirely based off of the charts and technical analysis. I also like to find under-$10 names with a catalyst, but that's secondary to the chart and volume patterns.

With that in mind, here's a look at several under-$10 stocks that look poised to potentially trade higher from current levels.

Must Read: 10 Stocks Billionaire John Paulson Loves in 2014

Sizmek

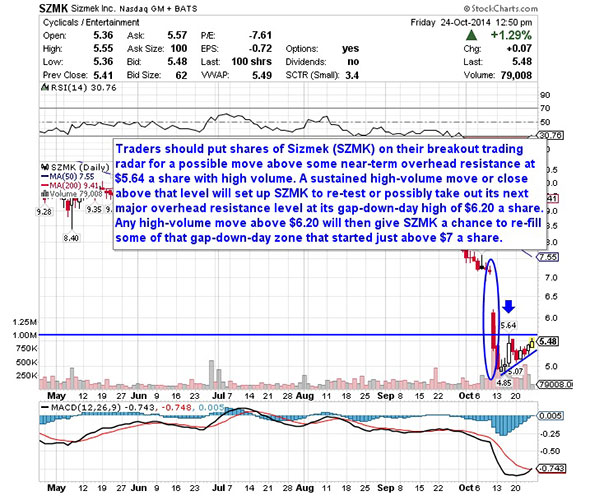

One under-$10 advertising player that's starting to trend within range of triggering a major breakout trade is Sizmek (SZMK), which provides online advertising delivery and optimization services worldwide. This stock has been destroyed by the sellers so far in 2014, with shares off sharply by 46%.

If you take a glance at the chart for Sizmek, you'll see that this stock has been downtrending badly for the last four months, with shares plunging lower from its high of $10.20 to its new 52-week low of $4.85 a share. During that move, shares of SZMK were consistently making lower highs and lower lows, which is bearish technical price action. This stock also gapped down sharply a few weeks ago from over $7 to under $5.50 with heavy downside volume. Following that move, shares of SZMK have started to rebound off that $4.85 low and it has now started to uptrend a bit. That move is quickly pushing shares of SZMK within range of triggering a big breakout trade.

Traders should now look for long-biased trades in SZMK if it manages to break out above some near-term overhead resistance at $5.64 a share with high volume. Look for a sustained move or close above that level with volume that registers near or above its three-month average action of 177,312 shares. If that breakout develops soon, then SZMK will set up to re-test or possibly take out its next major overhead resistance level at its gap-down-day high of $6.20 a share. Any high-volume move above $6.20 will then give SZMK a chance to re-fill some of that gap-down-day zone that started just above $7 a share.

Traders can look to buy SZMK off weakness to anticipate that breakout and simply use a stop that sits right around some key near-term support at $5.07 a share or around its 52-week low of $4.85 a share. One can also buy SZMK off strength once it starts to take out $5.64 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: 5 Stocks Insiders Love Right Now

Baxano Surgical

Another under-$10 medical device player that's setting up to break out here is Baxano Surgical (BAXS), which designs, develops and markets minimally invasive products to treat degenerative conditions of the spine affecting the lumbar region. This stock has been decimated by the sellers so far in 2014, with shares down huge by 87%.

If you take a look at the chart for Baxano Surgical, you'll notice that this stock has started to form a potential major bottoming chart pattern over the last month, with shares finding buying interest right above or around 10 cents per share. This pattern is starting to emerge after shares of BAXS saw some extreme downside volatility in late September, when the stock plunged in just a few trading sessions from over 30 cents per share to around 13 cents per share. Shares of BAXS are now starting to spike higher off those near-term support levels and it's starting to move within range of triggering a major breakout trade above a key downtrend line.

Market players should now look for long-biased trades in BAXS if it manages to break out above some key near-term overhead resistance levels at 15 cents per share to 17 cents per share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 899,211 shares. If that breakout triggers soon, then BAXS will set up to re-test or possibly take out its next major overhead resistance levels at 19 cents per share to its 50-day moving average of 24 cents per share.

Traders can look to buy BAXS off weakness to anticipate that breakout and simply use a stop that sits right below its 52-week low of 10 cents per share. One can also buy BAXS off strength once it starts to take out those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: Sell These 5 Toxic Stock Before November

Foamix Pharmaceuticals

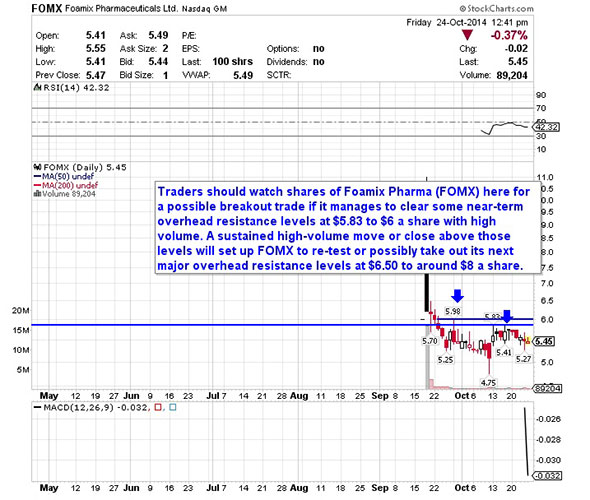

One under-$10 specialty pharmaceutical player that's starting to move within range of triggering a near-term breakout trade is Foamix Pharmaceuticals (FOMX), which develops and commercializes foam-based formulations acne, impetigo, and other skin conditions. This stock is off notably so far in 2014, with shares down by 11.5%.

If you take a glance at the chart for Foamix Pharmaceuticals you'll notice that this stock has been trending sideways and consolidating for the last month, with shares moving between $4.75 on the downside and around $6 on the upside. Shares of FOMX have now started to spike higher right above that $4.75 low and it's quickly pushing within range of triggering a near-term breakout trade above the upper-end of its recent sideways trading chart pattern.

Traders should now look for long-biased trades in FOMX if it manages to break out above some near-term overhead resistance levels at $5.83 to $6 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average volume of 919,488 shares. If that breakout develops soon, then FOMX will set up to re-test or possibly take out its next major overhead resistance levels at $6.50 to around $8 a share.

Traders can look to buy FOMX off weakness to anticipate that breakout and simply use a stop that sits right below some key near-term support at $5.27 a share or around its all-time low of $4.75 a share. One can also buy FOMX off strength once it starts to clear those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Must Read: 7 Stocks Warren Buffett Is Selling in 2014

Arcos Dorados

Another under-$10 restaurant player that's starting to move within range of triggering a major breakout trade is Arcos Dorados (ARCO), which is an Argentina-based company engaged in the operation of McDonald's franchisees. This stock has been destroyed by the sellers so far in 2014, with shares off dramatically by 49%.

If you look at the chart for Arcos Dorados, you'll notice that this stock has started to uptrend over the last few weeks, with shares moving higher from its low of $5.40 to its recent high of $6.38 a share. During that move, shares of ARCO have been making mostly higher lows and higher highs which is bullish technical price action. This move has started to emerge after shares of ARCO were downtrending badly over the last four months, with the stock plunging from its high of $11.32 to its new 52-week low of $5.40 a share. This near-term stabilization and slight uptrend for ARCO could be signaling that an overall trend change is shaping up. Plus, shares of ARCO are starting to move within range of triggering a big breakout trade.

Market players should now look for long-biased trades in ARCO if it manages to break out above some near-term overhead resistance levels at $6.38 to $6.41 a share and then above its 50-day moving average of $6.44 a share to more key near-term resistance at $7 a share with high volume. Look for a sustained move or close above those levels with volume that hits near or above its three-month average action of 813,532 shares. If that breakout develops soon, then ARCO will set up to re-test or possibly take out its next major overhead resistance level at $8 to its 200-day moving average of $8.79 a share.

Traders can look to buy ARCO off weakness to anticipate that breakout and simply use a stop that sits right below some near-term support at $5.80 a share or right around its 52-week low of $5.40 a share. One can also buy ARCO off strength once it starts to bust above those breakout levels with volume and then simply use a stop that sits a comfortable percentage from your entry point.

Sunesis Pharmaceuticals

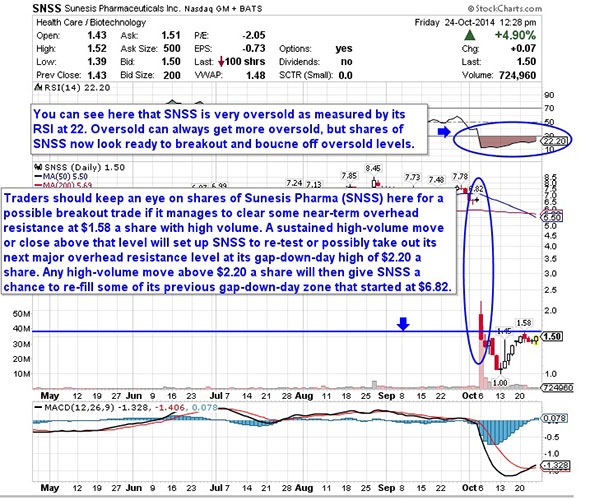

An under-$10 biopharmaceutical player that's quickly moving within range of triggering a big breakout trade is Sunesis Pharmaceutical (SNSS), which focuses on the development and commercialization of oncology therapeutics for the treatment of solid and hematologic cancers. This stock has been destroyed by the sellers so far in 2014, with shares down sharply by 71%.

If you take a glance at the chart for Sunesis Pharmaceuticals, you'll see that this stock recently gapped down sharply from $6.82 a share to below $1.50 a share with monster downside volume. Following that move, shares of SNSS continued to slide lower with the stock making a new 52-week low at $1 a share. That massive collapse in the share price for SNSS has now pushed the stock into extremely oversold territory, since its current relative strength index reading is 22. Oversold can always get more oversold, but shares of SNSS have already started to rebound off at $1 low and it's now quickly moving within range of triggering a big breakout trade.

Traders should now look for long-biased trades in SNSS if it manages to break out above some near-term overhead resistance at $1.58 a share with high volume. Look for a sustained move or close above that level with volume that registers near or above its three-month average action 2.11 million shares. If that breakout materializes soon, then SNSS will set up re-test or possibly take out its next major overhead resistance level at its gap-down-day high of $2.20 a share. Any high-volume move above $2.20 a share will then give SNSS a chance to re-fill some of its previous gap-down-day zone that started at $6.82 a share.

Traders can look to buy SNSS off weakness to anticipate that breakout and simply use a stop that sits right around $1.30 to $1.25 a share. One can also buy SNSS off strength once it starts to take out $1.58 a share with volume and then simply use a stop that sits a comfortable percentage from your entry point.

To see more hot under-$10 equities, check out the Stocks Under $10 Setting Up to Explode portfolio on Stockpickr.

-- Written by Roberto Pedone in Delafield, Wis.

RELATED LINKS:

>>How to Trade the Market's Most-Active Stocks

>>Book Double the Gains With These Shareholder Yield Champs

>>4 Stocks Spiking on Big Volume

Follow Stockpickr on Twitter and become a fan on Facebook.

At the time of publication, author had no positions in stocks mentioned.

Roberto Pedone, based out of Delafield, Wis., is an independent trader who focuses on technical analysis for small- and large-cap stocks, options, futures, commodities and currencies. Roberto studied international business at the Milwaukee School of Engineering, and he spent a year overseas studying business in Lubeck, Germany. His work has appeared on financial outlets including

CNBC.com and Forbes.com. You can follow Pedone on Twitter at www.twitter.com/zerosum24 or @zerosum24.Friday, October 24, 2014

1 Way Intel Corporation Is Trying to Make Even More Money

Back on its fourth quarter 2011 earnings call, Intel's (NASDAQ: INTC ) CFO Stacy Smith boasted that 2011 was the second year in a row that the company saw the average selling prices of its PC chips increase. Smith attributed a good part of this upward mix shift to the additional capabilities, such as graphics, that Intel was integrating onto its chips.

These days, most laptops and low-end PCs don't even come with stand-alone graphics chips; the graphics processors that Intel integrates into its processors are generally more than enough. This has allowed Intel to "absorb" the value that a stand-alone graphics chip supplier would capture, helping average selling prices and margins.

Thanks to the folks at CPU World, some fresh new details of what Intel is doing with respect to graphics functionality in future products have emerged.

Let's dig deeper.

Embedded DRAM in future Ultrabook processors

Late this year and during the first half of next year, Intel will be selling processors based on its Broadwell architecture. However, during the second half of 2015, Intel has announced that it will be manufacturing and selling chips based on its next architecture, known as Skylake.

CPU World reports that the 15-watt variants of Skylake intended for Ultrabooks/thin and light notebooks will feature what Intel calls "GT3e" graphics. This will allegedly feature 48 "Gen. 9" graphics processor cores and, perhaps more interestingly, will feature a 64-megabyte on-package embedded DRAM cache.

The motivation behind including such an on-package cache is simple: Graphics processors are well known for needing high amounts of memory bandwidth to deliver optimal performance. As the graphics processors integrated into Intel's processors get faster, so do the memory bandwidth requirements. A relatively large and fast cache helps with that.

Intel first introduced such a cache onto its Core i7 processors with Iris Pro graphics (aimed at high performance laptops such as the 15-inch MacBook Pro with Retina Display), and it seems that Intel is trying to bring this technology to higher-end thin-and-light notebooks.

Revenue upside for Intel

Intel is likely to be able to charge a significant amount more for its Ultrabook processors with eDRAM cache than it can for models without it. While this means that lower cost Ultrabooks won't get these parts, I suspect that premium thin and light notebooks such as a potential late 2015/early 2016 MacBook Air will adopt such processors.

This should translate into upside in the average selling prices of Intel's PC processors, which could help Intel grow PC-related revenue, even in an environment in which PC demand isn't growing all that quickly.

What's next for Intel?

I think what we are seeing Intel do with graphics is just the first step; the company will most likely be looking for any other ways to sell more content into the PC. For example, Intel CEO Brian Krzanich has talked about how he expects 15% of PCs by 2018 to include LTE connectivity. While the potential revenue upside from cellular-in-PCs probably isn't huge, this seems like a fairly straightforward way to grow average selling prices.

Perhaps Intel will talk more about its plans around growing its revenue per PC further at its investor meeting scheduled for Nov. 20.

Foolish bottom line

It would be ideal if the PC market was showing renewed signs of growth across the board. However, if the market does turn out to be a very slow growth or even a negative growth one over the long-term, then Intel will need to focus on delivering more value per PC as well as taking on as much market share as possible.

This is the strategy that Intel seems to be pursuing, and given Intel's financial performance this year, it seems to be working out fantastically for the company. I don't think the story on these fronts has finished playing out and look forward to what the company can do during 2015.

Apple Watch revealed: The real winner is inside

Apple recently revealed the product of its secret-development "dream team" -- Apple Watch. The secret is out, and some early viewers are claiming its everyday impact could trump the iPod, iPhone, and the iPad. In fact, ABI Research predicts 485 million of this type of device will be sold per year. But one small company makes Apple's gadget possible. And its stock price has nearly unlimited room to run for early in-the-know investors. To be one of them, and see where the real money is to be made, just click here!

Friday, October 17, 2014

Southwestern Paid How Much for Chesapeake Assets?

Chesapeake Energy (CHK) announced that it had sold 1,500 wells and the drilling rights to 413,000 acres to Southwestern Energy (SWN) today, and clearly the market thinks Chesapeake got a great price for its assets. It’s gained 14% to $20.26, while Southwestern Energy has dropped 8.2% to $32.77.

Associated Press

Associated Press SunTrust Robinson Humphrey’s Neal Dingmann and team estimate that Southwestern paid $9,625 an acre for the land, when previous deals in West Virginia had come in below $5,000. Obviously, Chesapeake got a good price, which also helps explain why Magnum Hunter Resources (MHR), Gulfport Energy (GPOR), and Consol Energy (CNX), among other West Virginia players, are also getting a bounce today.

Topeka Capital markets’ Gabriele Sorbara thinks Chesapeake’s deal means Magnum Hunter has 40% upside:

We believe Magnum Hunter has superior assets situated in the core Utica and Marcellus; however, this transaction has positive implications at the implied valuation. Based on our calculation, the assets were acquired for $13,015 per flowing Mcfe/d and $8,947 per acre (adjust for acquired production). An average of these transaction metrics on Magnum Hunter's production and acreage implies upside of 39.2%. We reaffirm our Buy and $10 price target. By early next year, we believe management will have transitioned to a pure-play Appalachia company with an improved balance sheet/capitalization and greater transparency on its Utica potential. Further, with its scale in the core Marcellus/Utica shale, we believe Magnum Hunter makes for an attractive takeout over the next 12 months.

Shares of Magnum Hunter have gained 3.3% to $4.69, while Gulfport Energy has advanced 4.6% to $46.11, and Consol Energy has risen 2.6% to $34.54.

Tuesday, October 14, 2014

Coach Continues With Its Innovation Stride

Coach Inc. (COH) recently announced that they will launch innovative limited edition series of their products, starting with a partnership with the Peanuts comic strip. The management has declared that characters from the Peanuts comic strip created by the late Charles Schulz will be the first theme in a series of limited edition projects initiated by Coach. Let's dive in and find out what sort of innovation is around the corner.

Coach Inc. (COH) recently announced that they will launch innovative limited edition series of their products, starting with a partnership with the Peanuts comic strip. The management has declared that characters from the Peanuts comic strip created by the late Charles Schulz will be the first theme in a series of limited edition projects initiated by Coach. Let's dive in and find out what sort of innovation is around the corner.

What is the new strategy

Coach will launch the products at Colette in Paris and afterward would be available through its website. The collection would range from bags and small accessories to black leather Snoopy dolls being offered on its website. The collection would be embossed with the popular Peanuts characters.

COH's executive creative director explained the idea behind this launch – "Coach has, for so many years, been an American institution so it seems fitting to honor that heritage with iconography that captures moments in American pop culture …. Peanuts and Snoopy were a rite of passage for a generation and continue to be so emotive. I was intrigued by the idea of taking that image and playfulness but subverting it. A rebellious spirit is contrasted with reassuringly natural Coach leather to create something unexpected."

Coach has been struggling with its financial numbers and is adopting strategies to put the company on the road to improve its brand image. The management urges to reset the company's branding from an "accessible luxury" brand to a "modern luxury" brand. This innovative step is a part of the new strategy taken by the management to grow both its top and bottom line.

A huge positive for the financials

COH is a highly profitable company

When Efforts to Save Money on Vacation Backfire

I thought my careful planning would save my family money when we took a vacation this past week. But you know what they say about best-laid plans …

SEE ALSO: 26 Secrets to Save on TravelOur week-long trip involved flying to Salt Lake City, then driving to Yellowstone National Park and Grand Teton National Park. I booked our flights early enough to score the low fares on Southwest Airlines for the particular route we were taking. Plus, I had enough frequent-flyer points to offset the cost of some of the tickets (see How to Earn Airline Miles Without Flying). And by flying Southwest, we would be able to check up to two bags per person for free.

However, our flight was canceled the night before we were scheduled to depart because we were flying through Chicago, where a fire at an air traffic control center disrupted air travel across the U.S. When I saw the e-mail notifying me of the cancellation, I called Southwest while my husband started searching online for flights on other airlines. After staying on hold for more than an hour, I finally spoke to a customer service representative who gave me a full refund for our canceled flight. And my husband managed to find a flight to Salt Lake City on US Airways for about $40 more per ticket than our original Southwest flight. Although we took a hit, it could've been much worse.

But then US Airways charged us $25 per checked bag. So we were out $75 for three checked bags. Carry-ons weren't an option since we needed several layers of clothing for the five of us to wear in the mountains, as well as a large hiking backpack to hold our toddler during treks along trails.

I packed snacks to take on the plane, but we ended up buying a meal at the airport because we had to arrive before lunch for the first leg of our flight, then wait three hours before the second leg, which departed right at dinner time.

Then our first day in Yellowstone, we had to buy hats for the kids. I didn't pack any (even though my husband said I should) because the forecast was calling for highs in the 60s. But there were high winds, and it didn't get much above 50 degrees.

Fortunately, though, my planning did help offset some of the additional expenses we incurred.

Because our original flight was scheduled to arrive in Salt Lake City late in the afternoon, we had decided to stay the first night of our trip there before heading north the next day to Yellowstone. We also needed to book a room in Salt Lake City the night before our return home because we had an early flight. So I took advantage of points I had racked up with a hotel-branded rewards credit card to get two free stays at a hotel with free breakfast (see our picks for best hotel rewards cards).

My husband took advantage of a discount through his employer to get a deal on a rental car. And because we would be going to Yellowstone and Grand Teton, the only thing we had to pay for four days of sightseeing was a $25 fee that covered the entrance to both national parks.

If we had gone in the summer, we would've camped to save money. But with temperatures forecasted to drop into the 30s at night, and the bears in the parks in the process of fattening up ahead of winter hibernation, camping with three young kids wasn't a good option on this trip. We booked a room in one of Yellowstone's lodges for two nights, then took advantage of off-season rates at a lodge (with free breakfast) in Jackson, Wyo., near Grand Teton.

We also packed reusable water bottles so we wouldn't have to pay for overpriced bottled water. We also brought a collapsible cooler that we filled with food purchased before entering the national parks so we wouldn't have to pay for high-priced meals within the parks (see more ways to cut the cost of travel with kids).

And we told our two daughters beforehand that they had to use their own money to buy souvenirs. Our 2-year-old has no money of his own, so he didn't get a souvenir. But he did get to see Old Faithful, waterfalls, snow-covered mountains, elk, bison, moose, wolves and even a grizzly bear. That's better than any souvenir, right?

Sunday, October 12, 2014

The U.S. Oil Export Surge Is Coming

My wife and I just returned home from a family event in Seattle, and something there caught my eye that will have a big effect on energy investors.

Something is now afoot in the Pacific Northwest that is going to change how we think about pricing oil - and this new wrinkle is going to provide a range of fantastic opportunities for investors.

It revolves around the prospect of U.S. oil exports and the changes that will be needed to make it all happen...

Preparing for a Generational Change in U.S. Oil ExportsThese preparations are already underway. In fact, entire networks are now being restructured to increase the transport of oil to the West Coast for export to Asia.

Of course, this will still require an act of Congress, since the government restriction against exports in the wake of the oil embargo of the early 1970s is still on the books.

But as I have mentioned before, that change is certainly coming.

And from the looks of what is taking shape among pipeline administrators, tanker companies, port authorities, and railways, the broad-based assumption is that this decades-old policy will be revised soon. Local officials in port cities throughout the Pacific Northwest are counting on it.

And from the looks of what is taking shape among pipeline administrators, tanker companies, port authorities, and railways, the broad-based assumption is that this decades-old policy will be revised soon. Local officials in port cities throughout the Pacific Northwest are counting on it.

But it's the companies that will haul, offload, and transport the oil that are moving first. Several major industry meetings are now scheduled on the West Coast on the subject, whereas last year there were none.

According to veteran officials at the Port of Seattle, the expected revisions will be one of the largest changes in American export policy (and shipping priorities) in several generations.

Of course, the West Coast will not be the only area affected. But it does have the advantage of being the ready loading point for deliveries to Asia. And the Asian market is where the energy expansion over the course of the next two decades will be the most pronounced, offering the highest profit potential and greatest pricing differentials available anywhere on the market.

All of which adds up to the massive move that is now taking shape to start sending crude out of the United States.

Growing U.S. Production Alters the BalanceWhat makes all of this possible, of course, is the resurgence of U.S. oil production. The onset of huge unconventional (shale, tight, heavy) oil reserves has caused our concerns about sufficient oil supplies to become a non-issue.

Meanwhile, the market offering the highest rate of return is foreign, especially in those regions with developing economies and accelerating populations. This is hardly news, since these regions of the world have been driving oil prices for some time now.

What changes the equation this time around is where that supply will be sourced.

As it stands, Asia currently pays a premium for deliveries of Saudi and other OPEC oil. Put simply, it costs more for an Asian end user to secure crude than for the equivalent consignment to be delivered just about anywhere else on earth.

Despite everything that has taken place, it is still cheaper to receive a crude oil tanker in Galveston than it is in Japan, China, or India. The so-called "Asian premium" has long been a fact of life to do business there.

However, some new additions are now about to upset that balance.

One is the growing use of the East Siberia-Pacific Ocean (ESPO) export pipeline, which moves Russian oil for export and also has a spur for the direct transit of crude by land to Northwest China.

As this develops, ESPO will also introduce a new crude benchmark rate (also named ESPO). In fact, these flows have already become sufficient enough to justify pricing quotes from Argus in London. What's more, the oil is of better quality than Saudi crude (lower sulfur content) and, once the confidence in regular deliveries builds, it should begin to cut into the additional price paid by Asia.

But this is not going to happen overnight.

Even still, Asian consumers would certainly welcome another major oil exporter that was in a position to compete with OPEC and Russian sources. The continent is certainly going to need all of the oil it can secure.

Shifting the Flow of Oil to the Pacific NorthwestThat's why what's happening in places like Seattle is so important.

The combination of U.S. and Canadian production becoming available - all without sacrificing any domestic needs - is tailor-made for where the energy balance is heading. As the energy balance shifts toward Asia, so also will the exports.

Already, the movement of crude south from Canada to the United States by rail has emerged as a major change in North American transit corridors. Plans are underway to build central offloading facilities to move oil from railcars and pipelines to tankers headed across the Pacific.

At some point, the Keystone XL pipeline will be approved and construction of the last major leg in the largest North American crude pipeline network will finally get underway.

By that point, the ability of the United States to be effectively self-sufficient in both oil and natural gas will have become a reality. By 2025 (maybe even sooner), the American market will only need to import about 30% of its daily requirements. That's down from almost 70% only a few years ago.

Those imports will come primarily from Canada. Other sources will only be utilized if they benefit from cost-side considerations.

As a result, the United States will be left with significant additional production over and above what is needed. So there is no longer any strategic reason to prevent U.S. oil exports.

In fact, there is too much to gain from an employment and tax base perspective, which means the political pressure to allow exports will grow.

As the policy change meets the infrastructure development, a number of companies all along this new value chain will become great targets for investment.

Also, as we begin to see a short-term ceiling forming for oil prices, do not forget these simple facts.

First, as I recently explained, making profits in the oil sector is no longer dependent upon the rising price of oil.

Second, the United States will have plenty of excess oil for some time to come.

Finally, even with the changes taking place in the trading balance, prices (and therefore profits) will be higher in Asia.

All of these conditions will set the stage for the coming U.S. oil export surge... and our ability to profit from it.

And don't forget: The Gulf and East Coasts are about to benefit big time from the export of liquefied natural gas (LNG) to Europe and Asia.

It all adds up to be an exciting time for energy investors.

More from Dr. Kent Moors: Making money in the energy sector is no longer pegged to higher oil prices. But it does require a different approach. This is the best way to profit from crude oil prices right now...