MEXICO CITY ��Taco stand owner Pompilio Jim茅nez held high hopes when Mexican President Enrique Pe帽a Nieto took office. But a year of slow sales and decreased security in his hometown on the outskirts of Mexico City has given him second thoughts.

"He promised more jobs and more security," says Jim茅nez, who recounts being robbed and receiving extortion calls demanding cash in recent months. "It's been completely the opposite."

Pe帽a Nieto arrived in office one year ago on Dec. 1, 2012, promising to calm the country and produce long-stalled structural reforms, which he said would allow Mexico to achieve 6% annual growth.

"This is Mexico's moment," he said in his inaugural address ��a line often repeated by boosters and analysts alike, summing up the sense of optimism for the Pe帽a Nieto as he attempted to turn the page on years of insecurity and subpar economic growth.

Top Growth Stocks To Own For 2015: Intuitive Surgical Inc.(ISRG)

Intuitive Surgical, Inc. designs, manufactures, and markets da Vinci surgical systems for various surgical procedures, including urologic, gynecologic, cardiothoracic, general, and head and neck surgeries. Its da Vinci surgical system consists of a surgeon?s console or consoles, a patient-side cart, a 3-D vision system, and proprietary ?wristed? instruments. The company?s da Vinci surgical system translates the surgeon?s natural hand movements on instrument controls at the console into corresponding micro-movements of instruments positioned inside the patient through small puncture incisions, or ports. It also manufactures a range of EndoWrist instruments, which incorporate wrist joints for natural dexterity for various surgical procedures. Its EndoWrist instruments consist of forceps, scissors, electrocautery, scalpels, and other surgical tools. In addition, it sells various vision and accessory products for use in conjunction with the da Vinci Surgical System as surgical procedures are performed. The company?s accessory products include sterile drapes used to ensure a sterile field during surgery; vision products, such as replacement 3-D stereo endoscopes, camera heads, light guides, and other items. It markets its products through sales representatives in the United States, and through sales representatives and distributors in international markets. The company was founded in 1995 and is headquartered in Sunnyvale, California.

Advisors' Opinion: - [By John Kell]

Among the companies with shares expected to actively trade in Friday’s session are Intuitive Surgical Inc.(ISRG), Juniper Networks Inc.(JNPR) and Microsoft Corp.(MSFT)

- [By Anders Bylund]

Plenty of companies operate behind a business moat, which makes it hard for competitors to steal their thunder. Intuitive Surgical (NASDAQ: ISRG ) made its moat a mile wide, filled it with boiling acid, and populated it with mutant alligators.

- [By Rich Smith]

While billed as a rival to America's Intuitive Surgical (NASDAQ: ISRG ) , Mazor actually bears closer resemblance to tiny Hansen Medical (NASDAQ: HNSN ) . Lacking profits despite raking in nearly $15 million in revenues last year, Mazor doesn't generate positive free cash flow like Intuitive does. Instead, it burns it like Hansen does (albeit more slowly). Last year, negative free cash flows amounted to $2.1 million, which suggests that Wallachbeth's endorsement may be a bit premature.

Top Growth Stocks To Own For 2015: CNO Financial Group Inc. (CNO)

CNO Financial Group, Inc., through its subsidiaries, engages in the development, marketing, and administration of health insurance, annuity, individual life insurance, and other insurance products for senior and middle-income markets in the United States. The company markets and distributes Medicare supplement insurance, interest-sensitive and traditional life insurance, fixed annuities, and long-term care insurance products; Medicare advantage plans through a distribution arrangement with Humana Inc.; and Medicare Part D prescription drug plans through a distribution and reinsurance arrangement with Coventry Health Care. It also markets and distributes supplemental health, including specified disease, accident, and hospital indemnity insurance products; and life insurance to middle-income consumers at home and the worksite through independent marketing organizations and insurance agencies. In addition, the company markets primarily graded benefit and simplified issue life insurance products directly to customers through television advertising, direct mail, Internet, and telemarketing. It sells its products through career agents, independent producers, direct marketing, and sales managers. CNO Financial Group, Inc. has strategic alliances with Coventry and Humana. The company was formerly known as Conseco, Inc. and changed its name to CNO Financial Group, Inc. in May 2010. CNO Financial Group, Inc. was founded in 1979 and is headquartered in Carmel, Indiana.

Advisors' Opinion: - [By Jonas Elmerraji]

Up first is CNO Financial Group (CNO), a mid-cap financial stock that's rocketed close to 60% higher since the calendar flipped over to January. Yup, it's been a great year for the market, but it's been a far better one for investors who own CNO. But that strong performance isn't showing any signs of slowing yet. In fact, CNO looks primed for even more upside in the fourth quarter.

That's because CNO is currently forming a bullish pattern called an ascending triangle. The ascending triangle pattern is formed by a horizontal resistance level above shares -- in this case at $14.75 -- and uptrending support to the downside. Basically, as CNO bounces in between those two technical price levels, it's getting squeezed closer and closer to a breakout above that $14.75 resistance level. When that breakout happens, it's time to become a buyer.

ACCO's price action isn't exactly textbook. After all, the pattern is coming in at the bottom of a downtrend, not after an uptrend. But ultimately, that doesn't change the trading implications of a move through that $7.50 level.

Whenever you're looking at any technical price pattern, it's critical to think in terms of those buyers and sellers. Ascending triangles and other pattern names are a good quick way to explain what's going on in a stock, but they're not the reason it's tradable. Instead, it all comes down to supply and demand for shares.

That $7.50 resistance level is a price where there has been an excess of supply of shares; in other words, it's a place where sellers have been more eager to step in and take gains than buyers have been to buy. That's what makes a breakout above it so significant. The move means that buyers are finally strong enough to absorb all of the excess supply above that price level.

Don't be early on this trade.

- [By David Fried, Editor, The Buyback Letter]

Insurance holding company CNO Financial Group (CNO) and its insurance subsidiaries��rincipally Bankers Life and Casualty Company, Washington National, and Colonial Penn Life Insurance Company��erve pre-retiree and retired Americans.

Buffalo Wild Wings, Inc. engages in the ownership, operation, and franchise of restaurants in the United States. The company provides quick casual and casual dining services, as well as serves bottled beers, wines, and liquor. As of July 26, 2011, it had 773 Buffalo Wild Wings locations in 45 states in the United States, as well as in Canada. The company was founded in 1982 and is headquartered in Minneapolis, Minnesota.

Advisors' Opinion: - [By Sean Williams]

Buffalo Wild Wings (NASDAQ: BWLD )

Just because consumers refuse to give up their ability to take a vacation doesn't mean they aren't looking for other creative ways to save a dollar. Unless you're staying with family, you don't have much choice when it comes to food -- you have to eat out. I'm going out on a limb and projecting that Buffalo Wild Wings will be one of the biggest beneficiaries of consumers who dine out this summer. If you've kept up with the company's rapid expansion, you'd notice that it's moving into warmer, hot-spot vacation destinations within the United States. In addition, it's been adding new menu items that are reasonably priced and won't break a family of four's bank. With BWW's big sports-bar appeal and NCAA sponsorship, getting traffic into its restaurants this summer shouldn't be difficult. As long as chicken prices cooperate, I expect a sizable upside surprise from BWW in the coming quarters.

- [By Brian Pacampara]

Based on the aggregated intelligence of 180,000-plus investors participating in Motley Fool CAPS, the Fool's free investing community, restaurant operator Buffalo Wild Wings (NASDAQ: BWLD ) has earned a respected four-star ranking. �

- [By Chris Hill]

Bikinis Sports Bar & Grill has trademarked the term "breastaurant." Are restaurants like these a threat to "non-breastaurants" like Buffalo Wild Wings (NASDAQ: BWLD ) ? In this installment of MarketFoolery, our analysts discuss what it all means for investors.

Top Growth Stocks To Own For 2015: Sara Lee Corporation(SLE)

Sara Lee Corporation engages in the manufacture and marketing of a range of branded packaged meat, bakery, and beverage products worldwide. Its packaged meat products include hot dogs and corn dogs, breakfast sausages, sandwiches and bowls, smoked and dinner sausages, premium deli and luncheon meats, bacon, beef, turkey, and cooked ham. It also offers frozen baked products, which comprise frozen pies, cakes, cheesecakes, pastries, and other desserts. In addition, Sara Lee provides roast, ground, and liquid coffee; cappuccinos; lattes; and hot and iced teas, as well as refrigerated dough products. The company sells its products under Hillshire Farm, Ball Park, Jimmy Dean, Sara Lee, State Fair, Douwe Egberts, Senseo, Maison du Caf

Top Growth Stocks To Own For 2015: Thoratec Corporation(THOR)

Thoratec Corporation engages in the development, manufacture, and marketing of proprietary medical devices used for circulatory support. The company?s primary product lines include ventricular assist devices, such as HeartMate II, an implantable left ventricular assist device consisting of a rotary blood pump to provide intermediate and long-term mechanical circulatory support (MCS); and HeartMate XVE, an implantable and pulsatile left ventricular assist device for intermediate and longer-term MCS. Its ventricular assist devices also comprise Paracorporeal Ventricular Assist Device, an external pulsatile ventricular assist device, which provides left, right, and biventricular MCS approved for bridge-to-transplantation (BTT), including home discharge, and post-cardiotomy myocardial recovery; and Implantable Ventricular Assist Device, an implantable and pulsatile ventricular assist device designed to provide left, right, and biventricular MCS approved for BTT comprising hom e discharge, and post-cardiotomy myocardial recovery. The company also provides CentriMag, an extracorporeal full-flow acute surgical support platform that offers support up to 30 days for cardiac and respiratory failure. In addition, it offers PediMag and PediVAS extracorporeal full-flow acute surgical support platforms designed to provide acute surgical support to pediatric patients. The company sells its products through direct sales force in the United States, as well as through a network of distributors internationally. Thoratec Corporation was founded in 1976 and is headquartered in Pleasanton, California.

Advisors' Opinion: - [By Todd Campbell]

Competing for heart pump market share

Abiomed's products provide circulatory support for up to six hours and are designed for use in cardiac cath labs or during heart surgery, but competitors Thoratec (NASDAQ: THOR ) and Heartware (NASDAQ: HTWR ) target the intermediate- and long-term-use market instead.

- [By Brian Pacampara]

What: Shares of medical device company Thoratec (NASDAQ: THOR ) sank 12% today after its quarterly results missed Wall Street expectations. �

Top Growth Stocks To Own For 2015: Checkpoint Systms Inc.(CKP)

Checkpoint Systems, Inc. manufactures and markets identification, tracking, security, and merchandising solutions for the retail and apparel industry worldwide. The company operates in three segments: Shrink Management Solutions, Apparel Labeling Solutions, and Retail Merchandising Solutions. The Shrink Management Solutions segment provides shrink management and merchandise visibility solutions. It offers electronic article surveillance systems, such as EVOLVE, a suite of RF and RFID-enabled products that act as a deterrent to prevent merchandise theft in retail stores; and electronic article surveillance consumables, including EAS-RF and EAS-EM labels that work in combination with EAS systems to reduce merchandise theft in retail stores. This segment also provides keepers, spider wraps, bottle security, and hard tags, as well as Showsafe, a line alarm system for protecting display merchandise. In addition, it offers physical and electronic store monitoring solutions, incl uding fire alarms, intrusion alarms, and digital video recording systems for retail environments; and RFID tags and labels. The Apparel Labeling Solutions segment provides apparel labeling solutions to apparel retailers, brand owners, and manufacturers. It has Web-enabled apparel labeling solutions platform and network of 28 service bureaus located in 22 countries that supplies customers with customized apparel tags and labels. The Retail Merchandising Solutions segment offers hand-held label applicators and tags, promotional displays, and queuing systems. The company serves retailers in the supermarket, drug store, hypermarket, and mass merchandiser markets through direct distribution and reseller channels. Checkpoint Systems was founded in 1969 and is based in Thorofare, New Jersey.

Advisors' Opinion: - [By Rich Smith]

Three months after settling upon a new chief executive officer, it looks like Thorofare, N. J.-based Checkpoint Systems (NYSE: CKP ) will soon have itself a new CFO as well.

- [By John Udovich]

Small cap Checkpoint Systems, Inc (NYSE: CKP) fights shoplifting or retail theft and other forms of�"shrink��that costs retailers over $112 billion worldwide last year (according to a study funded by the company), meaning it might be an interesting stock to take a closer look at and to compare its performance with that of SPDR S&P Retail ETF (NYSEARCA: XRT) and PowerShares Dynamic Retail ETF (NYSEARCA: PMR). Just how bad can shoplifting or shrink be for a retailer? Troubled retailer J.C. Penney Company, Inc (NYSE: JCP) has just reported that shoplifting took a full percentage point off the department store chain's profit margins during the quarter. Moreover and given that tens of millions of Americans are now facing higher health insurance costs thanks to Obamacare (which will likely impact consumer discretionary spending),�retailers�will need to find ways to shore up their margins and bottom lines by preventing�retail theft with solutions from company�� like Checkpoint Systems.

Top Growth Stocks To Own For 2015: TrueBlue Inc.(TBI)

TrueBlue, Inc. provides temporary blue-collar staffing services in the United States. It supplies on demand general labor to various industries under the Labor Ready brand; skilled labor to manufacturing and logistics industries under the Spartan Staffing brand; and trades people for commercial, industrial, and residential construction, and building and plant maintenance industries under the CLP Resources brand. The company also provides mechanics and technicians to the aviation maintenance, repair and overhaul, aerospace manufacturing, and assembly industries, as well as to other transportation industries under the Plane Techs brand; and temporary drivers to the transportation and distribution industries under the Centerline brand. It primarily serves small and medium-size businesses. The company was formerly known as Labor Ready, Inc. and changed its name to TrueBlue, Inc. in December 2007. TrueBlue, Inc. was founded in 1985 and is headquartered in Tacoma, Washington.

Advisors' Opinion: - [By Jonathan Yates]

When looking at small cap stocks, it is useful to compare the company with others that have expanded in both share price and size. For those considering investing in the $100 billion staffing industry, the growth of TrueBlue (NYSE: TBI) shows what could be the potential path for Labor SMART (OTCBB: LTNC), as both operate in the $29 billion demand labor sector. Other firms have done well in the staffing industry include Paychex (NASDAQ: PAYX) and ManPower Group (NYSE: MAN).

- [By idahansen]

The entire demand labor industry should do well as the US Department of Labor just reported that 169,000 more jobs were added to the American economy. The more work there is, the more demand there is for the services of staffing solutions firms such as Labor SMART, Paychex (NASDAQ: PAYX), TrueBlue (NYSE: TBI), and Robert Half International (NYSE: RHI).

- [By Jonathan Yates]

For those looking to invest in real estate stocks, highly recommended is the Dr. Housing Bubble blog. In a recent posting, the "Dr." pointed out that there was a "Lost Generation" when it came to household income. That has not happened for those investing in staffing industry stocks such as Paychex (NASDAQ: PAYX), Robert Half International (NYSE: RHI), TrueBlue, Inc. (NYSE: TBI), and Labor SMART (OTCBB: LTNC).

Top Growth Stocks To Own For 2015: Waste Management Inc.(WM)

Waste Management, Inc., through its subsidiaries, provides waste management services to residential, commercial, industrial, and municipal customers in North America. It offers collection, transfer, recycling, and disposal services. The company also owns, develops, and operates waste-to-energy and landfill gas-to-energy facilities in the United States. Its collection services involves in picking up and transporting waste and recyclable materials from where it was generated to a transfer station, material recovery facility, or disposal site; and recycling operations include collection and materials processing, plastics materials recycling, and commodities recycling. In addition, it provides recycling brokerage, which includes managing the marketing of recyclable materials for third parties; and electronic recycling services, such as collection, sorting, and disassembling of discarded computers, communications equipment, and other electronic equipment. Further, the company e ngages in renting and servicing portable restroom facilities to municipalities and commercial customers under the Port-o-Let name; and involves in landfill gas-to-energy operations comprising recovering and processing the methane gas produced naturally by landfills into a renewable energy source, as well as provides street and parking lot sweeping services. Additionally, it offers portable self-storage, fluorescent lamp recycling, and medical waste services for healthcare facilities, pharmacies, and individuals, as well as provides services on behalf of third parties to construct waste facilities. The company was formerly known as USA Waste Services, Inc. and changed its name to Waste Management, Inc. in 1998. Waste Management, Inc. was incorporated in 1987 and is based in Houston, Texas.

Advisors' Opinion: - [By Holly LaFon]

He is avoiding Apple (AAPL) and IPOs, as they remind him of 1983, the year he learned the beauty of boring when blue chips such as Waste Management (WM) and Pepsico (PEP) were stumbling and selling cheap, while 30 glitzy PC stocks went public and soared. Since then, the blue chips have overcome their problems and rose in value again, and most of the PC companies are gone.

- [By Jonas Elmerraji]

Investors think Waste Management (WM) is a garbage stock right now. Why else would WM's short interest ratio hover around 12.6? Of course, Waste Management is in fact a garbage stock of sorts -- it is the largest waste management service provider in the country. The firm boasts more than 270 landfills and a massive fleet of trash collection vehicles that spans the U.S.

When I think garbage firms, the first thing that comes to mind is dividends: WM and its peers historically have generous, recession-resistant dividend payouts. Currently, Waste Management's yield adds up to 3.36% annually. Don't forget, dividends are like kryptonite to short sellers.

WM's willingness to embrace innovation has big potential in the years ahead. Right now, the firm's portfolio includes 22 waste-to-energy plants that are designed to turn the waste that WM literally gets paid to collect into renewable energy that the firm gets paid for again. At this point, the firm's energy plants make up a very small part of its total business, but waste-to-energy projects and the recent acquisition of small oil service firms should look attractive to investors right now.

Earnings in two months look like the next big catalyst for a short squeeze in WM.

- [By Chris Hill]

Waste Management (NYSE: WM ) reported a slight decline in first-quarter profits but revenues increased. Shares of the trash giant hit their highest point since 1999. In this installment of Motley Fool Money, our analysts talk about the future of Waste Management.

- [By Maxx Chatsko]

Consider that municipalities and industrial giants such as�Waste Management� (NYSE: WM ) �are converting their fleets -- in this case garbage trucks -- to�run on natural gas fuels�(link opens a video). It's a little easier for Waste Management, since it uses biogas generated from its managed landfills to fuel its own vehicles. Clean Energy Fuels also sources biomethane from one of its landfills in Dallas. In fact, the facility can produce up to 36,000 gasoline-equivalent gallons�each day. It's like the old saying goes: One man's trash is another man's fuel.��

Top Growth Stocks To Own For 2015: Crocs Inc.(CROX)

Crocs, Inc. and its subsidiaries engage in the design, development, manufacture, marketing, and distribution of footwear, apparel, and accessories for men, women, and children. The company primarily offers casual and athletic shoes, and shoe charms. It also designs and sells a range of footwear and accessories that utilize its proprietary closed cell-resin, called Croslite. The company?s footwear products include boots, sandals, sneakers, mules, and flats. In addition, it provides footwear products for the hospital, restaurant, hotel, and hospitality markets, as well as general foot care and diabetic-needs markets. Further, the company offers leather and ethylene vinyl acetate based footwear, sandals, and printed apparels principally for the beach, adventure, and action sports markets; and accessories comprising snap-on charms. The company sells its products through the United States and international retailers and distributors, as well as directly to end-user consumers th rough its company-operated retail stores, outlets, kiosks, and Web stores primarily under the Crocs Work, Crocs Rx, Jibbitz, Ocean Minded, and YOU by Crocs brand names. As of December 31, 2010, it operated 164 retail kiosks located in malls and other high foot traffic areas; 138 retail stores; 76 outlet stores; and 46 Web stores. Crocs, Inc. operates in the Americas, Europe, and Asia. The company was formerly known as Western Brands, LLC and changed its name to Crocs, Inc. in January 2005. Crocs, Inc. was founded in 1999 and is headquartered in Niwot, Colorado.

Advisors' Opinion: - [By Chris Hill]

Visa (NYSE: V ) and Under Armour (NYSE: UA ) hit new all-time highs. General Motors (NYSE: GM ) appears to be turning the corner in Europe. And second-quarter profits for Crocs (NASDAQ: CROX ) fell a whopping 43%. In this installment of Investor Beat, Motley Fool analysts David Hanson and Jason Moser discuss four stocks making moves on Thursday.

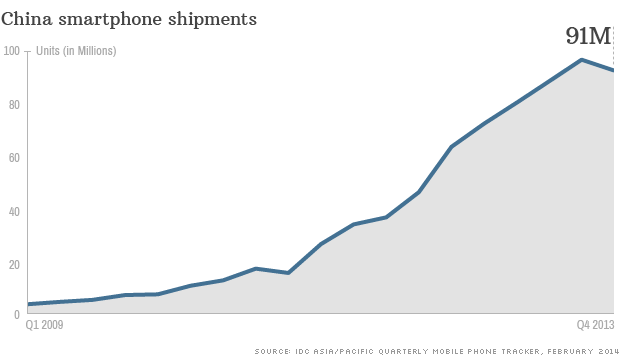

HONG KONG (CNNMoney) After years of blockbuster growth, the world's biggest smartphone market is cooling.

HONG KONG (CNNMoney) After years of blockbuster growth, the world's biggest smartphone market is cooling.  A personal trainer on your smartphone

A personal trainer on your smartphone  Bloomberg

Bloomberg

Popular Posts: 8 Pharmaceutical Stocks to Buy Now4 Commercial Banking Stocks to Buy Now7 Biotechnology Stocks to Buy Now Recent Posts: 5 Stocks With Prime Earnings Momentum — KNSY REGI STV FTEK EVAC 5 Stocks With Awful Earnings Momentum — FNBN GYRO MTGE PNX SHLD 5 Insurance Stocks to Sell Now View All Posts

Popular Posts: 8 Pharmaceutical Stocks to Buy Now4 Commercial Banking Stocks to Buy Now7 Biotechnology Stocks to Buy Now Recent Posts: 5 Stocks With Prime Earnings Momentum — KNSY REGI STV FTEK EVAC 5 Stocks With Awful Earnings Momentum — FNBN GYRO MTGE PNX SHLD 5 Insurance Stocks to Sell Now View All Posts

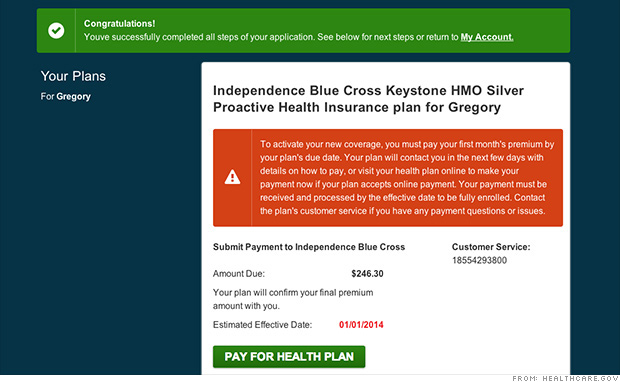

Last-minute rush to sign up for Obamacare

Last-minute rush to sign up for Obamacare  Associated Press

Associated Press