Toward the end of trading Friday, the Dow traded up 0.29 percent to 16,056.02 while the NASDAQ surged 0.52 percent to 3,989.78. The S&P also rose, gaining 0.46 percent to 1,804.22.

Top Headline

Foot Locker (NYSE: FL) reported a better-than-expected third-quarter profit.

Foot Locker's quarterly profit surged to $0.70 per share, versus $0.69 per share, in the year-ago period. However, its profit declined to $104 million versus $106 million. Excluding one-time items, it earned $0.68 per share.

Its revenue climbed to $1.62 billion from $1.52 billion. However, analysts were projecting earnings of $0.66 per share on revenue of $1.57 billion.

Equities Trading UP

Ariad Pharmaceuticals (NASDAQ: ARIA) shot up 34.05 percent to $3.72 after the company announced positive opinion by EMA on continued availability of Iclusig.

Shares of Splunk (NASDAQ: SPLK) got a boost, shooting up 22.70 percent to $73.50 after the company reported upbeat results for the third quarter and issued a strong forecast.

Aruba Networks (NASDAQ: ARUN) was also up, gaining 6.63 percent to $18.34 after the company reported upbeat Q1 results. Needham upgraded the stock from Hold to Buy.

Equities Trading DOWN

Shares of Nordic American Tankers (NYSE: NAT) were down 10.08 percent to $7.98 after the company announced the pricing of follow-on offering.

The Fresh Market (NASDAQ: TFM) shares tumbled 18.41 percent to $41.12 after the company reported downbeat Q3 results and issued a weak profit outlook. Sterne Agee downgraded the stock from Buy to Neutral and lowered the price target from $59.00 to $44.00.

Intel (NASDAQ: INTC) was also down, falling 5.31 percent to $23.90 after Nomura maintained its reduce rating on the company this morning following comments from the company's CFO at its analyst day Thursday that they expect PC sales down in the mid single digits range for 2014.

Commodities

In commodity news, oil traded down 0.58 percent to $94.89, while gold traded down 0.06 percent to $1,242.00.

Silver traded down 0.55 percent Friday to $19.86, while copper rose 0.77 percent to $3.22.

Eurozone

European shares were mostly higher today. The Spanish Ibex Index rose 0.75 percent, while Italy's FTSE MIB Index declined 0.11 percent. Meanwhile, the German DAX gained 0.20 percent and the French CAC 40 surged 0.58 percent while U.K. shares fell 0.11 percent.

Economics

US job openings climbed to 3.91 million in September, versus 3.84 million in August. However, job openings increased 8.6% y/y in September.

The Kansas City Fed manufacturing index rose to 7.00 in November, from a prior reading of 6.00. However, economists were expecting a reading of 6.00.

Posted-In: Earnings News Guidance Futures Forex Global Econ #s Economics Hot Intraday Update Markets Movers Tech

(c) 2013 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Around the Web, We're Loving... Come Learn 6 Proven Trading Strategies at Our Holliday Trading Summit Lightspeed Trading Presents: Intra-day and Swing Trading the First Two Hours of the Market Rumsfeld: Denial of Benefits to Fallen Soldiers' Families 'Inexcusable' Come See How the Pro's Trade in this Exclusive Webinar Facebook, Baidu Lead Big Caps Beating Shutdown What Should You Know About AMZN? Most Popular Voxeljet Shares Respond After Sour Citron Research Report Five Star Stock Watch: Groupon, Inc. China Mobile's iPhone 5S, iPhone 5C Set For December 18? Piper Jaffray Comments on Intel Following Company Analyst Day Apple Makes Supply Chain Adjustment to Increase Margins For the Patient Investor, High-Dividend, High Beta Stocks Can Be Highly Rewarding Related Articles (ARIA + ARUN) Mid-Day Market Update: US Stocks Gain; Fresh Market Shares Decline On Weak Results UPDATE: Deutsche Bank Reiterates on Aruba Networks Following FYQ1 Revenue Report Mid-Morning Market Update: Markets Open Mixed; Foot Locker Profit Beats Estimates Benzinga's Top #PreMarket Gainers Top 4 Small-Cap Stocks In The Networking & Communication Devices Industry With The Highest Revenue JMP Securities Reiterates on Continued Momentum on Share Gains and New Product Sales

).

).

This is where 70% of tax dollars go NEW YORK (CNNMoney) The citizens of Illinois voted for a millionaire tax on Tuesday, but that doesn't mean it's going to become law.

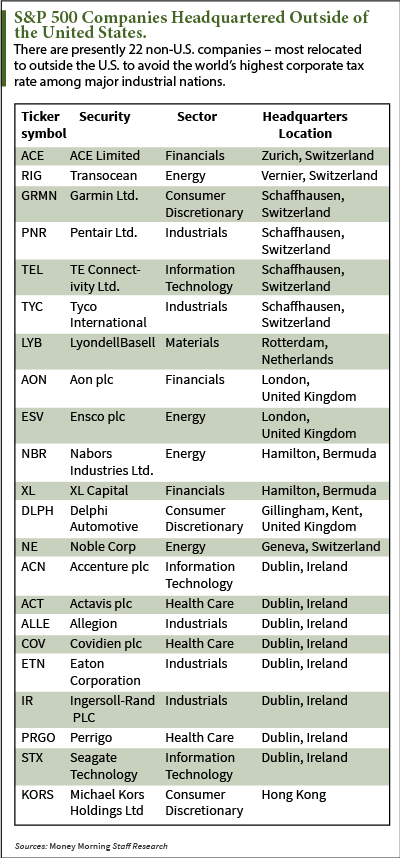

This is where 70% of tax dollars go NEW YORK (CNNMoney) The citizens of Illinois voted for a millionaire tax on Tuesday, but that doesn't mean it's going to become law.  A tax inversion deal is a merger between a U.S and a foreign company specifically designed to allow the U.S. company to move its headquarters out of the United States to escape America's high corporate tax rate.

A tax inversion deal is a merger between a U.S and a foreign company specifically designed to allow the U.S. company to move its headquarters out of the United States to escape America's high corporate tax rate.

Diane Bondareff/Invision for Subway/AP There were plenty of winners and losers this week on Wall Street, with one restaurant chain improving its coffee and and another one suffering a data breach. Here's a rundown of the week's smartest moves and biggest blunders. Keurig Green Mountain (GMCR) -- Winner If you're craving a really fresh cup of coffee with your next $5 footlong, Subway has an answer. It's teaming up with Keurig Green Mountain to outfit all of its nearly 30,000 sandwich shops in the U.S. and Canada with Keurig brewers to serve coffee in single-serve doses. Roughly half of Subway eateries already use Keurig brewers to make coffee to order, instead of brewing entire pots that may go unused. That Subway is adopting it chain-wide is a win for both companies, but Keurig Green Mountain will benefit more from the spike in coffee makers and K-Cup sales. P.F. Chang's -- Loser P.F. Chang's is under the heat lamp after thousands of stolen credit and debit cards appeared on an underground marketplace for swiped plastic. Reports indicate that the one thing tying the cards together is that they had all been used at the casual Chinese chain between early March through mid-May. A new company webpage offers updates. Whether or not P.F. Chang's is vindicated, the headlines are likely to keep some customers away from the growing restaurant chain that offers American tweaks to Chinese cuisine. I guess those diners wound up with a misfortune cookie at the end of their meals. Too soon? Then adding an Orange "You Glad You Didn't Eat Here This Spring" Chicken entree to the menu is probably also out of the question. Amazon (AMZN) -- Winner Amazon Prime -- the popular loyalty shopping program with more than 20 million customers paying $99 a year -- has added another free perk. Amazon is adding a digital catalog of 1.2 million music tracks for streaming. Prime Music has its limitations. Not all of the major labels aren't on board, and those that are participating aren't allowing their newest and more marketable releases into the smorgasbord. Still, it makes Prime even prime-ier, which is always a win for the e-tail giant. McDonald's (MCD) -- Loser Grimace is doing a bit more grimacing these days. McDonald's reported on Monday that comparable restaurant sales slipped 1 percent at its domestic eateries in May. Stateside weakness isn't really much of a surprise. McDonald's is coming off of three consecutive quarters of negative comps, and store-level sales had been negative every month since last October before clocking in flat in April. Stability in April may have led some to believe that the chain was back, but now we see that McDonald's continues to fail at wooing hungry bargain hunters with its expanding menu. There's no Happy Meal here. Yum! Brands (YUM) -- Winner Yum! Brands' Taco Bell has become one of the most innovative players in fast food, having introduced Doritos Locos Tacos in 2012, Waffle Tacos three months ago and Quesaritos on Monday. And unlike other fast food giants, Taco Bell has been rewarded with a spike in sales whenever it rolls out something new. . More from Rick Aristotle Munarriz

Diane Bondareff/Invision for Subway/AP There were plenty of winners and losers this week on Wall Street, with one restaurant chain improving its coffee and and another one suffering a data breach. Here's a rundown of the week's smartest moves and biggest blunders. Keurig Green Mountain (GMCR) -- Winner If you're craving a really fresh cup of coffee with your next $5 footlong, Subway has an answer. It's teaming up with Keurig Green Mountain to outfit all of its nearly 30,000 sandwich shops in the U.S. and Canada with Keurig brewers to serve coffee in single-serve doses. Roughly half of Subway eateries already use Keurig brewers to make coffee to order, instead of brewing entire pots that may go unused. That Subway is adopting it chain-wide is a win for both companies, but Keurig Green Mountain will benefit more from the spike in coffee makers and K-Cup sales. P.F. Chang's -- Loser P.F. Chang's is under the heat lamp after thousands of stolen credit and debit cards appeared on an underground marketplace for swiped plastic. Reports indicate that the one thing tying the cards together is that they had all been used at the casual Chinese chain between early March through mid-May. A new company webpage offers updates. Whether or not P.F. Chang's is vindicated, the headlines are likely to keep some customers away from the growing restaurant chain that offers American tweaks to Chinese cuisine. I guess those diners wound up with a misfortune cookie at the end of their meals. Too soon? Then adding an Orange "You Glad You Didn't Eat Here This Spring" Chicken entree to the menu is probably also out of the question. Amazon (AMZN) -- Winner Amazon Prime -- the popular loyalty shopping program with more than 20 million customers paying $99 a year -- has added another free perk. Amazon is adding a digital catalog of 1.2 million music tracks for streaming. Prime Music has its limitations. Not all of the major labels aren't on board, and those that are participating aren't allowing their newest and more marketable releases into the smorgasbord. Still, it makes Prime even prime-ier, which is always a win for the e-tail giant. McDonald's (MCD) -- Loser Grimace is doing a bit more grimacing these days. McDonald's reported on Monday that comparable restaurant sales slipped 1 percent at its domestic eateries in May. Stateside weakness isn't really much of a surprise. McDonald's is coming off of three consecutive quarters of negative comps, and store-level sales had been negative every month since last October before clocking in flat in April. Stability in April may have led some to believe that the chain was back, but now we see that McDonald's continues to fail at wooing hungry bargain hunters with its expanding menu. There's no Happy Meal here. Yum! Brands (YUM) -- Winner Yum! Brands' Taco Bell has become one of the most innovative players in fast food, having introduced Doritos Locos Tacos in 2012, Waffle Tacos three months ago and Quesaritos on Monday. And unlike other fast food giants, Taco Bell has been rewarded with a spike in sales whenever it rolls out something new. . More from Rick Aristotle Munarriz Joe Raedle/Getty Images WASHINGTON -- U.S. consumer confidence fell in April over concerns about hiring and business conditions, even though many people foresee a strengthening economy in the months ahead. The Conference Board said Tuesday that its confidence index dropped to 82.3 from a March reading of 83.9. Despite the decline, consumer sentiment for the past two months has been at its strongest levels since January 2008, when the Great Recession was just beginning. Concerns about the state of the economy fell for the first time since the federal government partially shut down in October. Jennifer Lee, senior economist at BMO Capital Markets, said consumer sentiment tailed off in April because the pace of hiring, while strengthening, "is still slow, and the tougher environment is hurting American confidence." Even though consumers are a bit more downbeat about existing economic conditions, their outlook for future growth held steady, noted Conference Board economist Lynn Franco. The expectations component of the index rose to an eight-month high in April. Consumer confidence is closely watched because consumer spending accounts for about 70 percent of the U.S. economy. The number of people who thought jobs were hard to get rose slightly to 32.5 percent from 31.4 percent in March. Economists expect sentiment about the job market to brighten if the pace of hiring quickens. Employers added 192,000 jobs in March and 197,000 jobs in February, after cold winter weather had caused hiring to stall in the prior months. The unemployment rate held steady at 6.7 percent last month despite the hiring because more Americans are seeking work. People without jobs are counted as unemployed only when they start looking for one. The Labor Department will release its April employment report Friday. Economists have forecast that 210,000 jobs will have been added this month, according to a survey by FactSet. The April consumer sentiment report showed that households with incomes of more than $125,000 continue to have the most confidence in the economy, as do people younger than 35. Plans to buy autos and appliances fell in April, while slightly more Americans are considering whether to buy a home, according to the report. Those purchases could be influenced by interest rates. The Federal Reserve has held rates near historic lows, though mortgage rates have increased over the past year. At its December, January and March meetings, the Fed trimmed its monthly bond purchases. The purchases have been intended to keep long-term rates low. The Fed has cut back on its bond buying because it deems the recovery to have strengthened.

Joe Raedle/Getty Images WASHINGTON -- U.S. consumer confidence fell in April over concerns about hiring and business conditions, even though many people foresee a strengthening economy in the months ahead. The Conference Board said Tuesday that its confidence index dropped to 82.3 from a March reading of 83.9. Despite the decline, consumer sentiment for the past two months has been at its strongest levels since January 2008, when the Great Recession was just beginning. Concerns about the state of the economy fell for the first time since the federal government partially shut down in October. Jennifer Lee, senior economist at BMO Capital Markets, said consumer sentiment tailed off in April because the pace of hiring, while strengthening, "is still slow, and the tougher environment is hurting American confidence." Even though consumers are a bit more downbeat about existing economic conditions, their outlook for future growth held steady, noted Conference Board economist Lynn Franco. The expectations component of the index rose to an eight-month high in April. Consumer confidence is closely watched because consumer spending accounts for about 70 percent of the U.S. economy. The number of people who thought jobs were hard to get rose slightly to 32.5 percent from 31.4 percent in March. Economists expect sentiment about the job market to brighten if the pace of hiring quickens. Employers added 192,000 jobs in March and 197,000 jobs in February, after cold winter weather had caused hiring to stall in the prior months. The unemployment rate held steady at 6.7 percent last month despite the hiring because more Americans are seeking work. People without jobs are counted as unemployed only when they start looking for one. The Labor Department will release its April employment report Friday. Economists have forecast that 210,000 jobs will have been added this month, according to a survey by FactSet. The April consumer sentiment report showed that households with incomes of more than $125,000 continue to have the most confidence in the economy, as do people younger than 35. Plans to buy autos and appliances fell in April, while slightly more Americans are considering whether to buy a home, according to the report. Those purchases could be influenced by interest rates. The Federal Reserve has held rates near historic lows, though mortgage rates have increased over the past year. At its December, January and March meetings, the Fed trimmed its monthly bond purchases. The purchases have been intended to keep long-term rates low. The Fed has cut back on its bond buying because it deems the recovery to have strengthened.